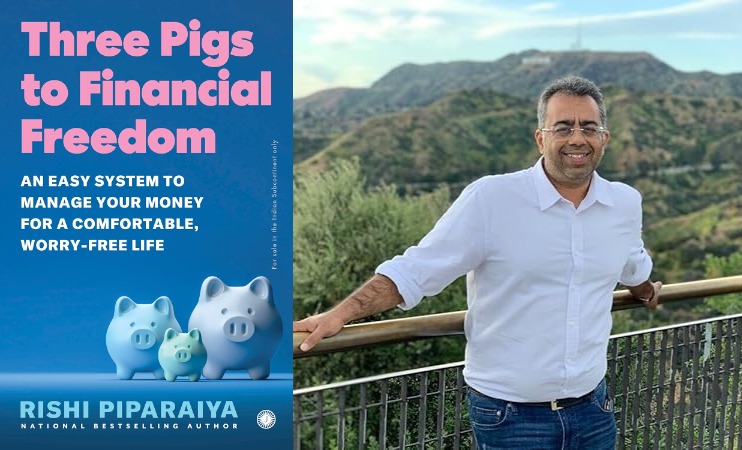

Ever wondered how much money you’d need to quit your job and live carefree? Or are you just hoping to afford a vacation without dipping into next month’s rent? Three Pigs to Financial Freedom by Rishi Piparaiya offers a roadmap to financial comfort and independence, delivering serious advice with a side of humour.

Piparaiya’s approach is refreshingly straightforward. Unlike some financial gurus and social media “finfluencers” who would have you believe wealth is built only on high-risk investments and portfolio acrobatics, Piparaiya advocates for simplicity and clarity. He introduces us to his “Three Pigs” model—a metaphor that sounds like it might belong in a bedtime story but actually provides a solid financial foundation. The pigs, as he calls them, are essentially three bank accounts labelled Needs, Wants, and Freedom. Let’s dive into each lesson Piparaiya offers, along with some insights on what he gets right, and where the book could have gone further.

Important Lessons from Rishi Piparaiya’s Three Pigs to Financial Freedom

- Define Your Goals and Know Your “Enough”

Piparaiya emphasises the importance of figuring out what financial freedom means to you. Is it about not worrying over bills or about being able to jet off to Europe at a moment’s notice? This part feels personal and grounded. Having a specific target, he argues, keeps you out of the rat race and helps you focus on what you need, not what society tells you to chase. - The Power of Three Accounts – The “Three Pigs”

Piparaiya’s main tactic for simplifying money management is using three separate accounts:- Needs: This account covers day-to-day expenses—groceries, bills, transportation, etc.

- Wants: Here’s where you save for those discretionary expenses—travel, gadgets, or even a new car.

- Freedom: This is the piggy bank for your future, building up savings that ideally remain untouched until you reach financial freedom.

This division brings much-needed clarity to spending, making it easier to allocate funds with purpose. The idea is practical and manageable, even for finance rookies.

- Investing Wisely without Over-Complicating

Piparaiya provides a basic breakdown of investment options, covering equity (stocks), debt (bonds), and Systematic Investment Plans (SIPs) with commendable clarity. He doesn’t overload the reader with jargon, which is refreshing, though perhaps a bit too elementary for seasoned investors. He suggests simple mutual funds, Public Provident Fund (PPF), and gold for the Freedom account, a strategy that makes sense for long-term, low-risk growth. - Avoid Loans (Mostly)

Piparaiya makes it clear: steer clear of loans unless they’re for an appreciating asset, like a home, or an education that can boost your earning power. The point is well-taken, and his warnings against the perils of credit card debt and “Buy Now, Pay Later” schemes are particularly apt for younger readers who may be prone to spending temptations. However, some readers may find his blanket stance on avoiding loans overly simplistic, especially when credit can be strategically managed. - Discipline and Patience: Two Underrated Virtues

Financial freedom isn’t an overnight trip, Piparaiya reminds us—it’s a marathon. His emphasis on sticking to the plan with patience and consistency is sound advice. It’s a refreshing counter to the get-rich-quick mentality prevalent in today’s financial advice industry. But readers may wish he had spent more time discussing ways to maintain motivation in the face of setbacks or financial crises.

Read more: Bhaskar Roy’s Fifty Year Road book review

What It Gets Right

Piparaiya’s real strength lies in making personal finance accessible. By using playful metaphors (the three pigs) and straightforward language, he manages to demystify a subject that many find intimidating. His approach is especially suitable for readers who are new to financial planning. The structure of the book is logical and easy to follow, which makes it an ideal starting point for people aiming to get a grip on their finances without getting overwhelmed by complex financial instruments or stock market chatter.

He also provides a refreshing perspective on financial freedom as being about “having enough” rather than amassing wealth for wealth’s sake. In a world where “more” is constantly marketed as better, Piparaiya’s advocacy for defining and focusing on one’s own financial “enough” feels surprisingly refreshing. The psychological freedom he describes—liberation from the rat race—is perhaps the book’s most valuable insight for me.

Where It Falls Short

While Three Pigs to Financial Freedom is a solid entry-level guide, it might not satisfy readers looking for advanced insights. The book leans heavily on traditional advice and doesn’t delve much into emerging financial trends or modern investment vehicles like exchange-traded funds (ETFs) or even robo-advisors. For millennials and Gen Z readers who are open to tech-driven solutions, this lack of depth might make the book feel somewhat dated.

Piparaiya’s approach to budgeting and saving also lacks flexibility. The rigid 60-30-10 division (Needs, Wants, Freedom) works well in theory but may not suit readers with fluctuating incomes, such as freelancers, or those supporting dependents. Additionally, his dismissal of speculative investments like Bitcoin may feel overly cautious to risk-tolerant readers looking to diversify beyond the conventional.

Equity, Debt, SIP: The Basics

For readers entirely new to investing, Piparaiya provides a simple rundown of key financial terms:

- Equity: Stocks that represent ownership in a company. He explains the potential for high returns but warns of the risks associated with stock market volatility.

- Debt: Bonds or fixed-income assets that offer safer but often lower returns. Piparaiya suggests debt instruments for conservative savers or for meeting short-term goals.

- SIP (Systematic Investment Plan): A method of investing in mutual funds with small, regular contributions. Piparaiya endorses SIPs for long-term wealth building, given their potential to harness the power of compounding.

For some, this introduction may be enough to get started, but more financially savvy readers might find the content too basic. A deeper dive into how to balance these investments according to different risk appetites would have been valuable.

Final Verdict

Three Pigs to Financial Freedom is a well-intentioned, no-nonsense guide to personal finance. It provides a clear, manageable system for organising one’s finances, making it ideal for beginners or anyone looking for a simpler approach to money management. Piparaiya’s humour and real-life anecdotes add a layer of relatability, making the book both informative and enjoyable.

That said, the book may leave readers seeking more advanced strategies or insights on cutting-edge financial tools feeling slightly unsatisfied. The advice is sound but leans on the conservative side, and some may find his reluctance to explore modern investment options a bit too cautious.

Overall, Three Pigs to Financial Freedom serves as a solid financial primer, particularly for young adults just beginning their financial journeys. If you’re looking to break down the basics of budgeting, debt management, and savings without drowning in finance jargon, this book is a great start. But for those who have already dipped their toes in the investment world, it might be best as a light refresher rather than a game-changer.

For more details, grab a copy here on Jaico’s website or from Amazon. A Kindle version is also available on the platform for download.

Happy reading! 🙂