The Maldives, a nation celebrated for its stunning landscapes and strategic geopolitical location, finds itself facing a daunting financial reality. The International Monetary Fund (IMF) has issued a warning that the country is at a high risk of debt distress, primarily due to its heavy borrowing from China. This development calls for an immediate reevaluation of economic policies to avert a looming financial crisis.

China’s Growing Influence in Maldives

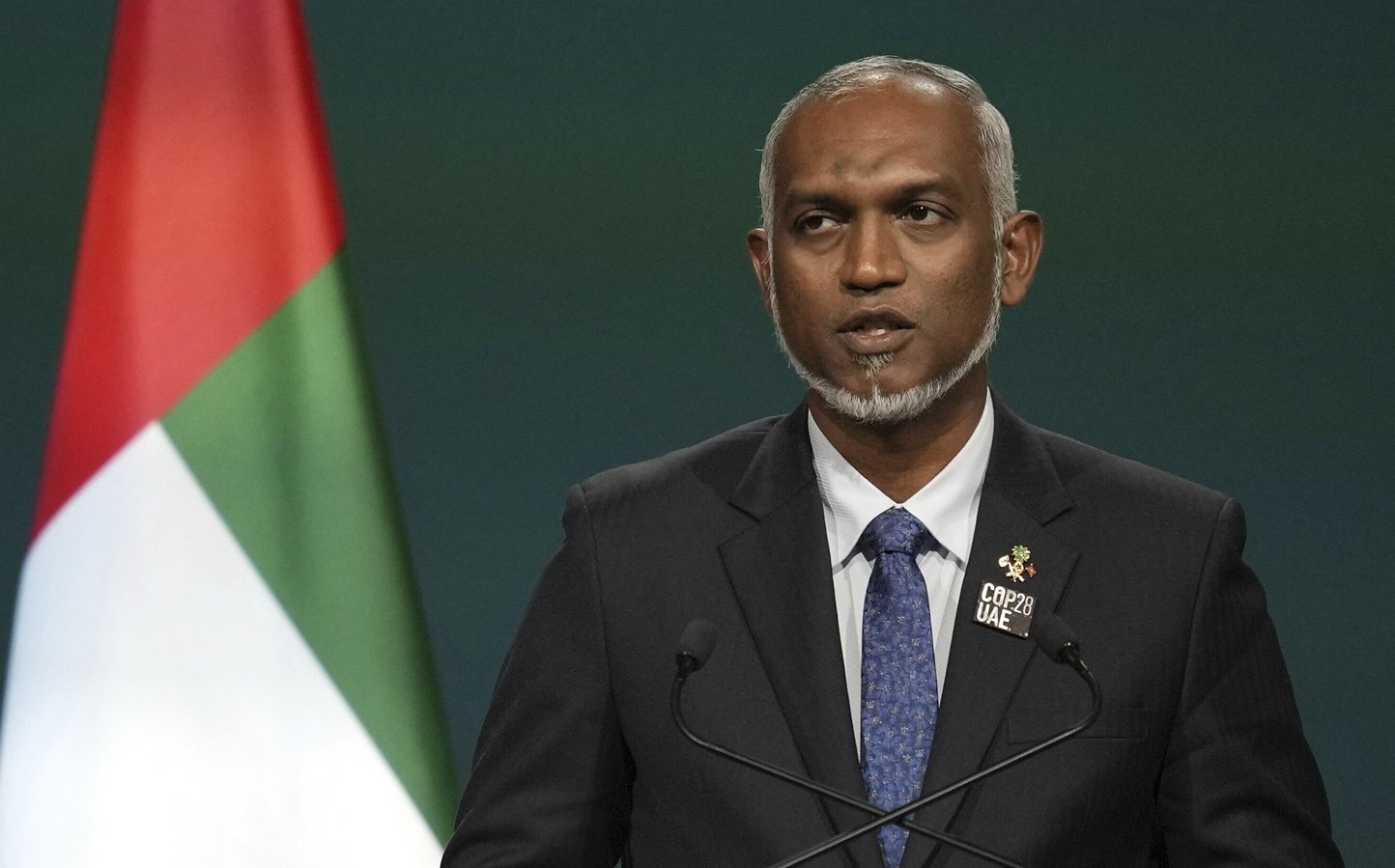

Under President Mohamed Muizzu’s administration, the Maldives has witnessed a significant shift towards China, moving away from its traditional ally, India. This pivot has resulted in increased Chinese funding and investments, intensifying the Maldives’ financial obligations to Beijing. The IMF, highlighting the urgency of the situation, points to the need for “urgent policy adjustment” to manage the burgeoning debt.

Image Source: @TimesAlgebraIND

The IMF’s Stark Warning

Assessing the Risk of Debt Distress

The IMF’s cautionary stance on the Maldives’ fiscal health is a wake-up call for the nation. Without disclosing specific figures, the Fund has underscored the critical nature of the Maldives’ foreign debt situation, advocating for substantial policy reforms to mitigate fiscal deficits and public debt levels that threaten to remain unsustainably high.

Economic Recovery Post-Pandemic

The Maldives’ economy, heavily reliant on tourism, has shown signs of recovery following the global COVID-19 pandemic. Plans for airport expansion and an increase in hotel capacity are expected to bolster economic growth. However, the IMF warns that the outlook is fraught with high uncertainty and risks, predominantly skewed to the downside.

Legacy of Debt

The strategic decisions made under former President Abdulla Yameen’s tenure, particularly the extensive borrowing from China for infrastructure projects, have left the Maldives with a heavy financial burden. According to the World Bank and the Maldives’ finance ministry, a significant portion of the country’s foreign debt is attributed to China, raising concerns about fiscal sustainability and sovereignty.

Defending National Interests

In response to the evolving geopolitical landscape, President Muizzu has expressed a commitment to strengthening the Maldives’ military capabilities. This move, aimed at protecting the nation’s vast maritime territory, underscores the strategic importance of the Maldives’ location along vital global shipping lanes.

The Plea for Regional Assistance

The economic challenges facing the Maldives have sparked a broader dialogue on regional support and cooperation. Notable figures, such as Hassan Kurusee, have vocalized the need for immediate financial aid from neighbouring countries, including India, to help stabilize the Maldives’ economy.

Towards Fiscal Resilience and Strategic Autonomy

The IMF’s warning about the Maldives’ high risk of debt distress due to its financial engagements with China serves as a critical juncture for the nation. It underscores the importance of implementing robust fiscal policies and diversifying economic strategies to ensure long-term stability and sovereignty. As the Maldives navigates this precarious financial landscape, the decisions made today will have lasting implications for its economic independence and strategic positioning in the region.

Adding to the narrative surrounding the Maldives’ financial predicament, it’s essential to consider the broader implications of the debt distress on the nation’s socio-economic fabric. The Maldives’ reliance on tourism, a sector vulnerable to global economic shifts and environmental challenges, amplifies the risk associated with heavy foreign borrowing.

The strategic location of the Maldives, straddling key maritime routes, not only accentuates its geopolitical significance but also places it at the centre of regional power dynamics. As the Maldives navigates its financial challenges, the role of international financial institutions like the IMF in providing guidance and support becomes crucial. These organisations advocate for transparency, sustainable debt management practices, and economic reforms aimed at diversifying the economy beyond tourism.

This approach is vital for the Maldives to achieve long-term economic resilience and maintain its sovereignty without being overly reliant on external debt, particularly from a single source like China. The unfolding scenario underscores the need for a balanced approach to development, one that safeguards the Maldives’ natural beauty, economic independence, and strategic interests.

Also read: Arvind Kejriwal skips 6th ED summons

Also read: What is a “Dunki” Trail?